What do I need to do to make online purchases with my Visa Debit card?

1. Activate 3-D Secure

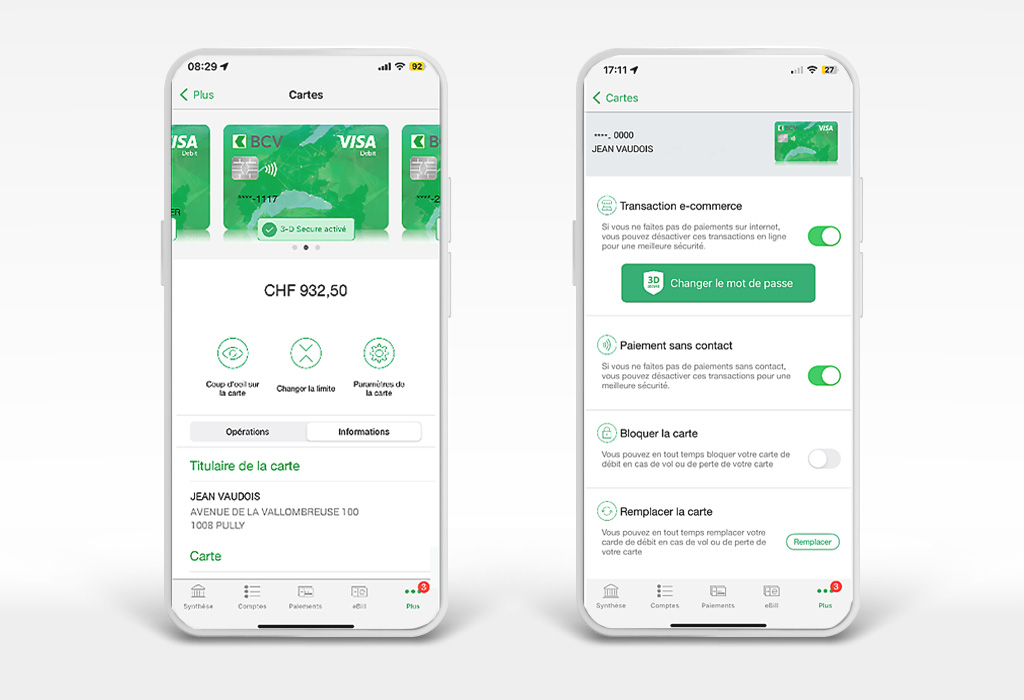

To activate 3-D Secure in BCV Mobile:

- go to More and then Cards

- under the Visa Debit card icon, click on “Activate 3-D Secure”

- enter and confirm a six-digit password for 3-D Secure, which you will need to enter when making online payments

- for better security and to simplify the process of authorizing purchases in the future, you can link your 3-D Secure password to your phone’s fingerprint ID or facial recognition function.

2. When it comes time to pay, all you need to do is enter the 16 digits that appear on the back of your card, the expiration date and the card verification code (CVC).

If a merchant does not offer “debit card” as a payment option, simply select “credit card” or “Visa card.” The transaction will be processed as a debit card payment.

3. Authorize your payments with 3-D Secure

Some online merchants require payment payment approval. If so, you will receive a payment approval request on your smartphone via push notification. To confirm payment, you simply have to click on the alert.

If you do not receive the push notification, you can see whether 3-D Secure verification is in process by clicking on the card icon located at the top of the home screen.

Are online payments made with a Visa Debit card secure?

Online purchases are secured in two ways: with 3-D Secure and with a powerful, automatic fraud-detection system.

For security reasons, if you want to be able to make online payments, you must first activate 3-D Secure: in BCV Mobile, go to More and then Cards, click on the Activate 3-D Secure button below the Visa Debit card icon, and then follow the instructions. This process will take only a few seconds.

When making a purchase from an online merchant that uses 3-D Secure, you will receive a push notification when you need to confirm a payment.

You can deactivate and reactivate the online purchase function at any time in BCV Mobile (go to More and then Cards).

What is 3-D Secure?

3-D Secure is a security standard for online payments.

It assesses the risks before you make an online purchase. If an additional step is required to authenticate your identity when making an online payment, you will have to confirm the payment in BCV Mobile.

3-D Secure increases the level of security for you and the merchant.

How does 3-D Secure work?

When it comes time to approve a Visa Debit card payment on a website that uses 3-D Secure, you will receive a push notification on BCV Mobile asking you to confirm the purchase.

If you do not receive the notification, you can open BCV Mobile and click on the card icon in the upper right corner of the home screen. There you will see whether a 3-D Secure payment approval request has been made.

Not all online merchants use 3-D Secure.

I didn't receive a push notification to confirm my online purchase. What should I do?

- See whether your smartphone has a network signal.

- Make sure it is not in airplane mode.

- If you are outside Switzerland and not connected to a WiFi network, make sure you have enabled data roaming.

- Check to see if there is a 3-D Secure payment approval request (click on the card icon in the upper right corner of the BCV Mobile home screen).

- You may need to wait a few minutes for the approval request to arrive.

If you make repeat purchases from the same online merchant, your payment habits may be recognized. If so, you may not always have to confirm such payments separately.

Not all online merchants use 3-D Secure.

What if I forget my 3-D Secure password?

You can change your 3-D Secure password in BCV Mobile:

- go to More and then Cards

- click on the settings (gear) icon below the Visa Debit card

- in the “Online merchant transaction” section, click on Change your password

- you will be asked to enter a new 3-D Secure password, which will replace the old one.

Is 3-D Secure required to make online payments?

Not all online purchases require additional approval through BCV Mobile. That depends on the merchant, the amount, and the cardholder’s purchasing habits.

Here are some reasons why 3-D Secure may not be used:

- The merchant does not use 3-D Secure.

- If you make repeat purchases from the same online merchant, your payment habits may be recognized. That way you will not have to confirm such payments separately.

But in order to use your card with all online merchants, you must activate 3-D Secure when your get your Visa Debit card.

What happens with 3-D Secure if I get a new smartphone?

3-D Secure is paired with a given device. So if you get a new smartphone, you will have to re-register for 3-D Secure with your new device (this will automatically deactivate 3-D Secure on your old one).

I can't activate 3-D Secure because my card does not show up in the Cards section of BCV Mobile. What should I do?

Make sure you have the latest, updated version of BCV Mobile on your smartphone.

Can I add my Visa Debit card to my digital wallet (e.g., TWINT, Google Pay, Apple Pay or Samsung Pay)?

No, Visa Debit cards cannot be saved in digital wallets. TWINT is already directly linked to the customer’s account and can be used to make in-store and online purchases in Switzerland.