- The equipment belongs to you and only you.

- You can use a single loan to acquire several items.

- A capital goods loan offers greater flexibility concerning the initial downpayment.

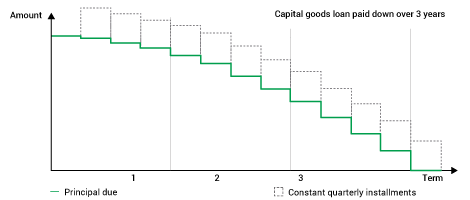

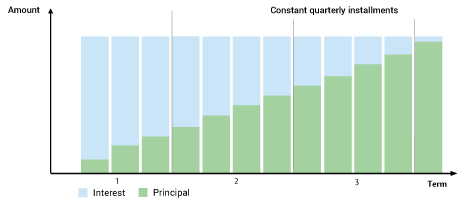

A capital goods loan is a fixed-rate loan. The term of the loan will depend on the useful life of the equipment in question. This type of loan gives you good visibility for your financial expenses, as installments remain constant throughout the term of the loan.

At the end of the useful life of the capital goods, the loan has been fully repaid.

|

Details |

|---|---|

Minimum amount |

|

Term |

|

Interest rates |

|

Principal and interest payments |

|

Credit Fee Schedule (250 Kb)

Dans toutes les phases de vie de votre entreprise, vous devez investir dans votre outil de production. Ces investissements peuvent être réalisés grâce au crédit Equipement.

File size : 127 KB - Last update: 07.04.2017