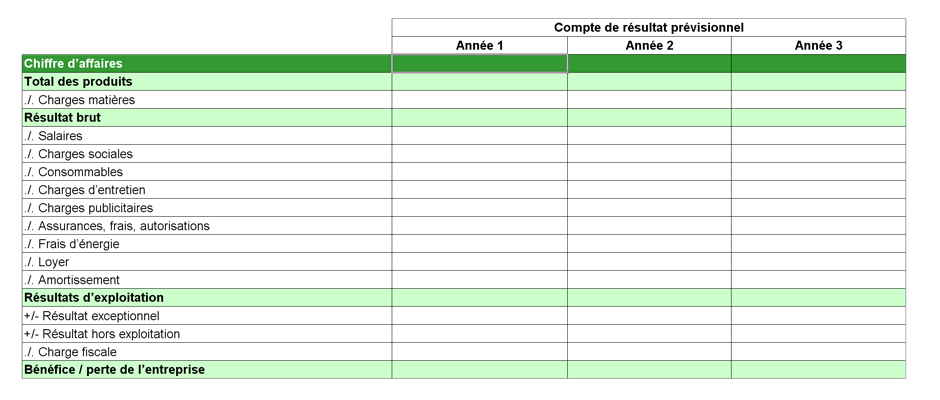

Earnings outlook

The projected income statement shows how you expect your company's revenues and expenses – and thus its overall performance – to change over time. As this is a forward-looking exercise, the byword should be caution. Do not underestimate future charges and do not overestimate future revenues. This analysis will help you determine your company’s earnings capacity.