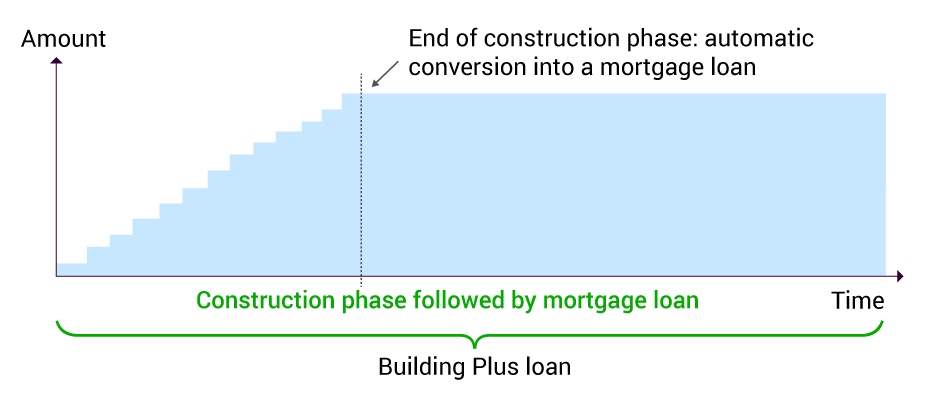

- With Building Plus, one loan – with only one interest rate – covers both the construction or renovation and then the subsequent mortgage loan for your business premises.

- The interest rate is fixed, which makes it easier for you to keep track of your financial expenses from the very beginning of your project. You can therefore plan ahead – and there won't be any nasty surprises on the way.

- As two products are combined into one, the terms are more attractive than with a conventional solution.

- Your building loan will be converted into a mortgage loan once construction is complete. But the date for the switch doesn't have to be specified when you take out the loan.

By continuing to use this website, you agree to our use of cookies to offer you personalized services and content, calculate statistics on website visits, and enable you to share content on social networks. Learn more.

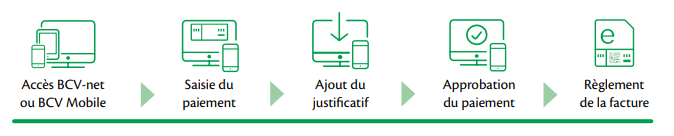

Be on the lookout for scammers! Never share your log-in details, bank card numbers, or PIN codes. BCV will never ask you for this information. Always double-check your payment orders (payee’s name, amount). Never install remote access software on your devices. Learn more