Choosing the right agreement

Choose the right range based on your ESG preferences: In our ESG range, our asset managers take ESG criteria into account when selecting investment products for your portfolio. Where competing products offer similar financial profiles, we favor those that best address ESG risks and opportunities. In our ESG Ambition range, a portion of your assets is invested in companies providing solutions to environmental and social challenges.

- ESG agreements: at least 70% of the instruments meet ESG criteria

- ESG Ambition agreements: 100% of the instruments meet ESG criteria and at least 25% of the portfolio is allocated to thematic investment products focused on companies making a difference to the environment and society (companies operating in the areas of renewable energy, energy efficiency, clean technology, water treatment, and positive societal change, for example).

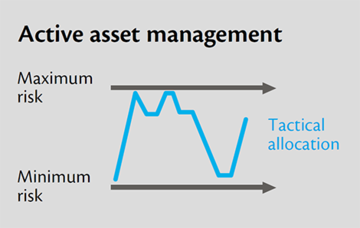

We tailor our agreements to your investor profile: Our offering covers two investment strategies and five risk profiles. A total of nine different types of management agreements are available. We’ll sit down with you to identify your investor profile, taking into account your financial capacity, your risk tolerance, your experience in finance, and your preferences for socially responsible investing.