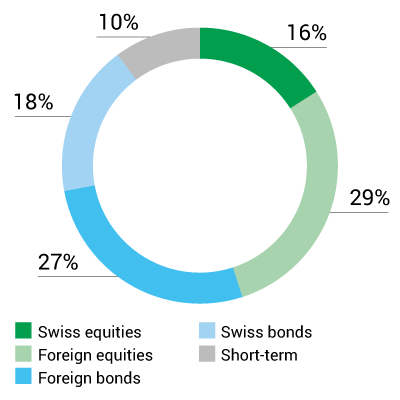

- Diversified solutions that implement BCV’s investment policy

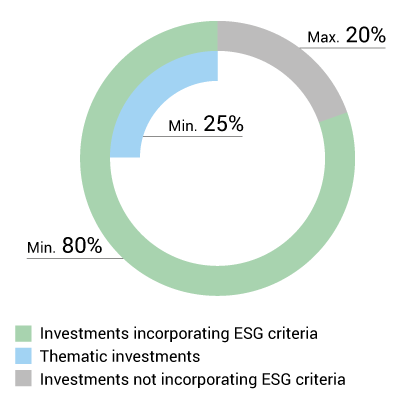

- Funds systematically incorporate ESG criteria while meeting strict financial criteria (performance, risk, liquidity, costs, quality)

- At least 25% of fund assets are allocated to thematic investments geared toward one or more of the United Nations Sustainable Development Goals (SDGs)

- Funds managed and closely monitored by a team of experts

By continuing to use this website, you agree to our use of cookies to offer you personalized services and content, calculate statistics on website visits, and enable you to share content on social networks. Learn more.

Be on the lookout for scammers! Never share your log-in details, bank card numbers, or PIN codes. BCV will never ask you for this information. Always double-check your payment orders (payee’s name, amount). Never install remote access software on your devices. Learn more