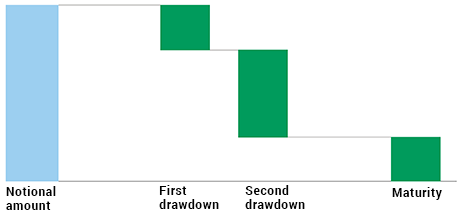

This product allows you to hedge your currency risk throughout an agreed period and draw down a predetermined notional amount at any point during that time.

The total amount of the currency you plan to buy or sell (depending on your needs), the exchange rate, and the term of the contract are set on the transaction date. The fixed rate will apply to any exchanges made during the product’s lifetime.

If, at maturity, you have not drawn down the full notional amount, you will have to draw down what is left on that date.